Real-Time Information (RTI) reporting is a critical compliance requirement for UK businesses, but staying on top of timely submissions to HMRC can be stressful. That’s where an RTI scheduler becomes invaluable helping employers automate and manage their payroll submissions accurately and efficiently. In this guide, we’ll break down everything you need to know about RTI scheduling, from setup and legal compliance to advanced tips for large organisations.

What is RTI and Why Does it Matter?

RTI stands for Real-Time Information. Introduced by HMRC in 2013, RTI revolutionised payroll reporting by requiring employers to submit PAYE information each time they pay employees not just once a year. This system ensures that tax, National Insurance, and student loan deductions are calculated and reported in real time.

Employers who fail to submit Full Payment Submissions (FPS) or Employer Payment Summaries (EPS) on time may face penalties. A RTI scheduler helps to automate these processes, ensuring you never miss a deadline.

What is an RTI Scheduler?

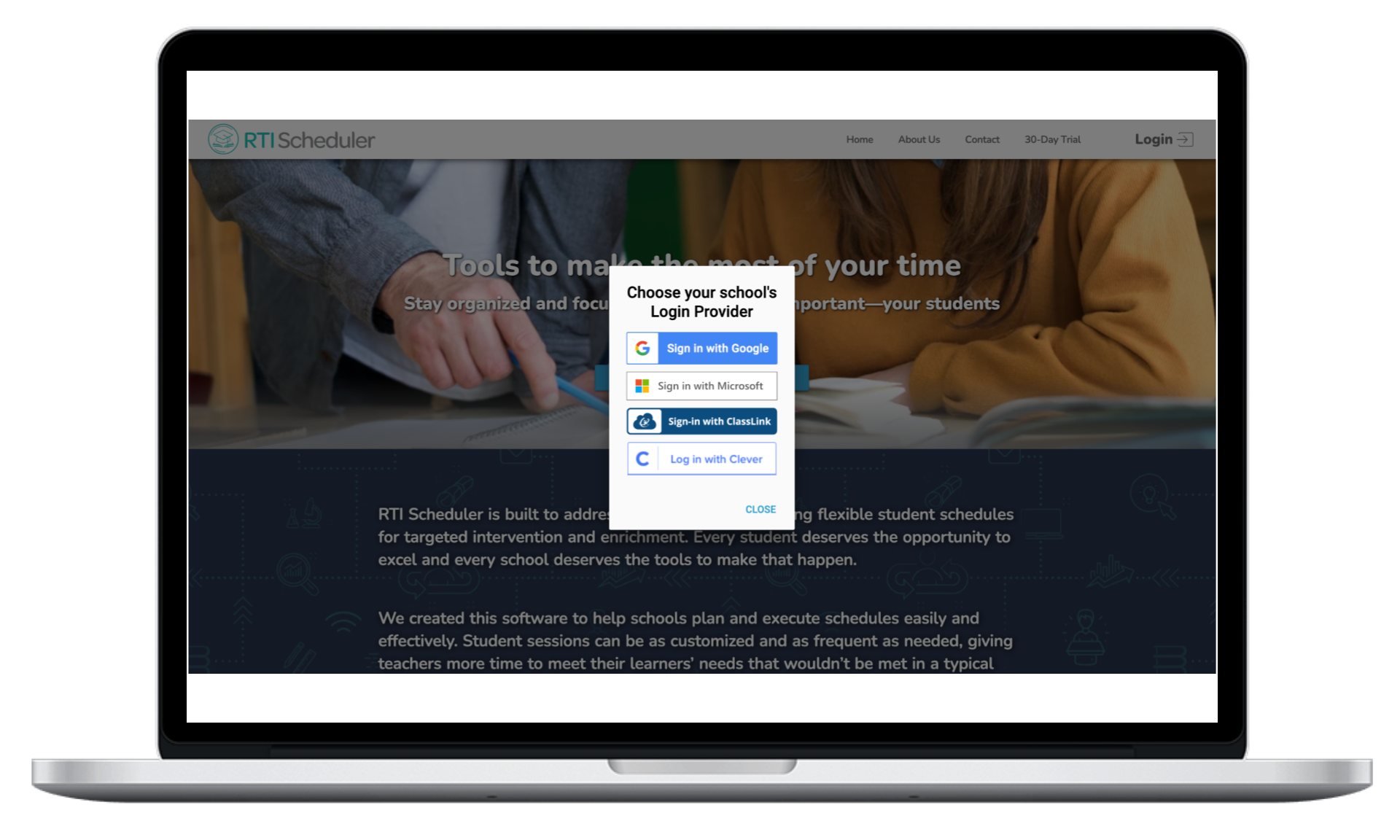

An RTI scheduler is a software feature or standalone tool that automates the submission of payroll data to HMRC in line with real-time reporting requirements. It allows employers to predefine when and how data is sent, reducing the need for manual input and ensuring timely compliance.

Most modern payroll software used in the UK includes some form of RTI scheduling functionality.

Key Benefits of Using an RTI Scheduler

A well-implemented RTI scheduler can:

- Ensure timely submissions: Automatically send FPS or EPS to HMRC on the correct date.

- Reduce human error: Avoid missed submissions or duplicate entries.

- Streamline operations: Integrate with payroll runs to send data in sync.

- Improve compliance: Stay up-to-date with HMRC requirements.

These benefits can significantly reduce stress for payroll departments and business owners alike.

How RTI Scheduling Works in Practice

Here’s a typical workflow:

- Payroll is processed – salaries, bonuses, and deductions are calculated.

- RTI Scheduler triggers submission – based on your schedule (e.g., every Friday).

- HMRC receives FPS/EPS – data is transmitted via a secure connection.

- Acknowledgement received – confirmation that HMRC has accepted the submission.

Most systems will log and notify you of submission status and any rejections.

Choosing the Right RTI Scheduler for Your Business

When selecting a solution, consider:

- Integration: Does it work with your payroll software?

- Customisation: Can you adjust submission timings or frequencies?

- HMRC Recognition: Is it listed as recognised software by HMRC?

- Support and Updates: Is the tool updated with changing regulations?

Popular UK payroll software with RTI schedulers includes BrightPay, Sage Payroll, Xero, and QuickBooks.

Legal Compliance and Deadlines

UK employers must submit RTI data on or before each payday. Common RTI submissions include:

- FPS (Full Payment Submission) – sent on or before the date employees are paid.

- EPS (Employer Payment Summary) – submitted when no payments are made or for adjustments.

A scheduler helps ensure compliance by automating this timeline and reducing the risk of HMRC penalties.

Common Issues and How to Avoid Them

Even with automation, issues can arise. Here’s how to avoid them:

- Check time zone settings – submission may be missed if your system uses incorrect time zones.

- Monitor rejections – always review confirmation receipts to catch any errors.

- Test before live run – especially when switching software or schedulers.

A robust RTI scheduler should flag any anomalies and help you rectify them before penalties occur.

RTI Scheduler for Large Businesses and Payroll Bureaus

Larger organisations and payroll providers need more advanced scheduling options. Key features to look for:

- Batch processing – submit multiple FPS for different PAYE schemes.

- User roles and permissions – control who can set or change schedules.

- Audit trails – essential for compliance and internal reviews.

In such cases, APIs and cloud-based tools offer better scalability and oversight.

Future Trends in RTI Scheduling

With advancements in AI and machine learning, RTI schedulers are becoming smarter:

- Predictive scheduling – systems will learn patterns and optimise timings.

- Automated error correction – software may self-correct common formatting issues.

- Integration with accounting – for a holistic view of payroll, tax, and cash flow.

Staying ahead with technology will give UK employers a competitive edge.

Conclusion

Using an RTI scheduler is no longer optional for most UK businesses—it’s a necessity for smooth, compliant payroll operations. Whether you’re a small business or an enterprise, automating your RTI submissions will save time, reduce errors, and avoid fines.